This is not investment advice. The author has no position in any of the stocks mentioned. Wccftech.com has a disclosure and ethics policy.

At its AI product launch earlier today, chip designer AMD upgraded its AI market estimates for 2023 by 50%, revealing that the total addressable market (TAM) for data center AI accelerators is now $45 billion. AMD launched new AI products today in a broader semiconductor market that is recovering from the demand-supply shocks that shrank revenues of all big-ticket semiconductor companies before the demand for AI GPUs and CPUs picked up in 2023.

The Santa Clara, California-based CPU and GPU designer's previous TAM estimate for the AI processor market was $30 billion. Its much larger GPU rival, NVIDIA, has managed to transform its income statement on the back of solid demand for AI GPUs. Unlike NVIDIA, AMD can sell x86 chips, which enables it to compete with Intel, and its Advancing AI event held earlier today was a star-studded affair attended by major cloud computing and data center firms such as Microsoft and Oracle.

AMD Embedded Computing President Touts End To End AI Product Portfolio From CPUs To FPGAs, As Perfectly Timed Xilinx Acquisition Yields Results

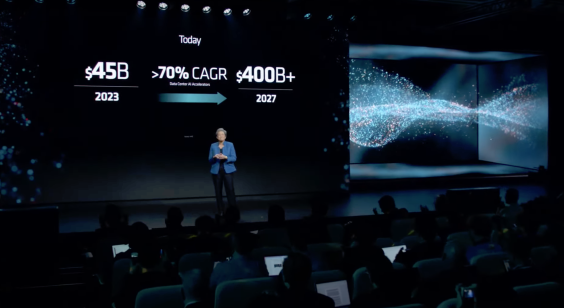

AMD's CEO, Dr. Lisa Su, kicked off the event by laying out her company's current and previous data center AI market estimates. She shared that a year ago, AMD estimated that the data center accelerated market would grow by 50% annually and sit at $150 billion in 2027.

Now, AMD has readjusted its market estimates after looking at the pace of market adoption. This has led to an upward revision of the data center TAM growth estimate to 70% to lend a final market value of $400 billion in 2027. As for its current value, the firm believes that the total revenue potential for its AI accelerators is $45 billion, a hefty jump from the $30 billion estimate from a year ago.

2 of 9

While NVIDIA has been in the headlines for its partnership with OpenAI, AMD's Advancing AI event saw its adaptive and embedding computing group president, Dr. Victor Peng, reveal that OpenAI will support MI300 Instinct GPUs. NVIDIA's data center revenues jumped by an unbelievable 279% during its previous fiscal quarter, sitting at $14.5 billion. Year to date, the firm has brought in roughly $25 billion to $29 billion by selling data center products, indicating that it commands more than half of the AI market.

Along with the headline MI300X launch, AMD also upgraded its AMD Ryzen 7040 "Phoenix" APUs by announcing an upcoming launch of a new product that aims to triple the generative AI performance of its predecessors.

The firm's shares appreciated by a little over 100 basis points in after-market trading, as most of the potential for future AI market growth has already been factored into a market digesting one set of economic data after another. NVIDIA's shares have been the star of the show in 2023, having gained 273% year to date. AMD, which has also recovered from a downturn last year, is up 82%, with its stock retaking its June high in November after Dr. Su highlighted her expectations for data center sales during the current quarter and full year 2024 at AMD's third quarter 2023 earnings call.

She outlined back then that AMD had $2 billion of AI product supply at hand, stressing that the semiconductor industry was in the "very early innings" of adopting AI products for business workload applications. Her response came when asked whether AMD had any plans to grow its revenue as a percentage of TAM (or market share), and Dr. Su's AI chip forecast boosted the stock after the earnings call, with the shares rising by 8% afterward.

In a talk with CNBC given after the event, the AMD chief maintained that the industry was still in the first couple of innings regarding AI adoption.

“We’re still at the very, very early innings of AI,” AMD CEO Lisa Su says. https://t.co/iaUqFj1Hkb pic.twitter.com/3MxjQYo9ng

— CNBC (@CNBC) December 6, 2023